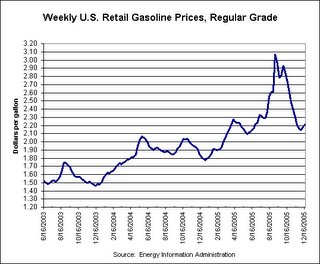

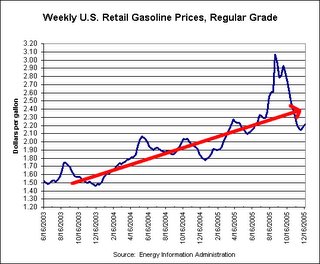

A look at this graph shows a steady increase in gasoline prices since late 2003. There's an obvious spike in price after hurricane Katrina which is followed by a correction and then a return to rising prices. Let's take that 23% increase for 2005 and do some projection for the next three years shall we?

2006 $2.69 per gallon

2007 $3.31 per gallon

2008 $4.07 per gallon

For all you non-math majors out there a 23% annual increase means the price will double every 3 years. Still worried about North Carolina's planned gas tax increase of $0.03 per gallon next year?

Ladies and gentlemen we have a larger problem.

4 comments:

Bro, your chart would not look nearly as steep if you backed it out over the past 20 years. True, gas may have risen 23% in 2005, but to assume that its going to continue to rise at that (spiked) rate each year over the next 3 years is not proper statistical analysis.

Just a thought. Keep it up!

Thanks for the comment. Reviewing only last year's gas price increase might be a bit narrow in scope. I would argue that examining the past 20 years would be too wide in scope. As we approach the peak of the mathematically smooth bell curve that represents oil production, prices will increase as conventional supply is unable to meet growth demand. I don't expect the years just before peak to resemble the years well before the peak. I reviewed the past three years of Charlotte's gas prices and found an average increase of only 13.3% annually. That means gas prices will only double every 5.6 years. That means we won't be paying over $4 per gallon until the middle of 2009.

I guess its the trend that's really the issue. If we could accurately predict the future we'd be buying stocks and cashing out in Vegas on the Super Bowl coin toss.

Heads or Tails? Another idea to keep in mind is that the peak in oil production globally will only be confirmed in retrospect. Technically the world's production rate of oil peaked in May 2005 (before Katrina I might add) http://www.theoildrum.com/uploads/12/monthly_total_deciea.gif

BUT that peak will only stand if it isn't surpassed in the future by an increase in production. When the U.S. peaked in 1970 it took years before everyone was willing to admit that production would never again rise above the amount in '70. The same thing will happen globally. The trend to keep you eye on is rising fuel prices indefinitely.

Post a Comment