Monday, October 24, 2005

Wednesday, October 19, 2005

something's got to give

I heard a radio news report this morning again telling the public not to worry, that there is plenty of energy in various forms “at the current rate of consumption”.

“…at the current rate of consumption, the coal reserve will indeed last roughly 250 years.”

- Physics Today Online

“The current estimate of the natural gas resource base in the 48 states…is equivalent to at least 65 to 70 years of supply at the current level of consumption…”

- American Gas Association

“How much uranium is there? The present reserves and resources… are about 3.5 million tones. This is enough to last some fifty years at the current consumption rate.”

-Open Democracy . Net

But something occurred to me. Isn’t our current financial system based on compounding interest? Isn’t the United States economy and by default the world economy based on growth?

“Since 1970, [United States] GDP growth has averaged 3.16 percent per year, after inflation.”

- The Heritage Foundation

“Between 1970 and 1995, a period of slow growth compared with the post-war decades, the Gross World Product grew by 2.9 percent annually” (Figure 1)

- The End of Economic Growth by Charles Siegel

Graph by: Organisation for Economic Co-operation and Development

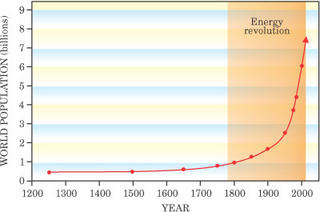

Graph by: Organisation for Economic Co-operation and DevelopmentIsn’t our population in this country and on this planet increasing? Won’t these additional persons want to drive and to eat and stay warm in the winter?

“…the total world demand for energy has increased by 32% between 1980 and 1998.

During the same period, the population increased by 33%.”

- Energy Information Administration

Graph by: Physics Today October 2005

Graph by: Physics Today October 2005

How can we be so blind as to accept predictions of ample energy “at the current rate of consumption” and still expect population growth and economic prosperity to continue?

Something’s got to give.

Graph from: The Peak of Oil Production and the Road to the Oldvai By Richard C. Duncan

Graph from: The Peak of Oil Production and the Road to the Oldvai By Richard C. Duncan

For more on exponential growth you’re welcome to read the following excerpt from "Forgotten Fundamentals of the Energy Crisis" by Dr. Albert A. Bartlett.

When a quantity such as the rate r( t ) of consumption of a resource grows a fixed percent per year, the growth is exponential:

r ( t ) = r0 e k t = r0 2 t / T2

where r0 is the current rate of consumption at t = 0, e is the base of natural logarithms, k is the fractional growth per year, and t is the time in years. The growing quantity will increase to twice its initial size in the doubling time T2where: T2 (yr) = (ln 2) / k » 70 / P

and where P, the percent growth per year, is 100k. The total consumption of a resource between the present (t = 0) and a future time T is:

C = {T to 0} r(t) dt

The consumption in a steady period of growth is:

C = r0 {T to 0} e kt dt = ( r0 / k ) ( e kt - 1 )

If the known size of the resource is R tons, then we can determine the exponential expiration time (EET) by finding the time Te at which the total consumption C is equal to R: R = ( r0 / k ) ( e kTe - 1 )

We may solve this for the exponential expiration time Te where:

EET = Te = ( 1 / k ) ln ( k R / r0 + 1 )

This equation is valid for all positive values of k and for those negative values of k for which the argument of the logarithm is positive.

-Albert A. Bartlett, Professor Emeritus of Physics at the University of Colorado in Boulder

Thursday, October 13, 2005

relocalization anyone?

Examination of this inevitable phenomenon reveals benefits for small towns and cities across America. Think about how the death of big box stores like Wal-mart will help local communities. Yes, at first this will displace those who work there. But the needs for goods previously provided by these stores will persist. Local businesses that don’t rely on the shipping of goods over vast distances could regain their footing. The foreign labor formerly responsible for the manufacturing of these goods will be supplanted by this change . What will be needed is labor close to home to get the job done.

Local manufacturing of all types not to mention repair work, food production (especially food production) and other industries could see a resurgence. There will be big bumps along the way. Many businesses reliant upon the current ease with which we move great distances daily will wither and fade away. Whole industries, even local ones might not make the transition. Trucking, for example, is in for a rocky road. I believe the key will be how quickly we recognize the inevitability of relocalization and respond accordingly. Unfortunately there will be those who resist the truth of situation and force hardship upon their communities because of a lack of vision. Pick your local leaders wisely and don’t forget to educate them.

Take advantage of relocalization.

Tuesday, October 11, 2005

hollywood's newest genre

Monday, October 10, 2005

the long emergency

October 5, 2005

Remarks by James Howard Kunstler

Author of The Long Emergency

In the waning months of 2005, our failure to face the problems before us as a society is a wondrous thing to behold. Never before in American history have the public and its leaders shown such a lack of resolve, or even interest, in circumstances that will change forever how we live.

Even the greatest convulsion in our national experience, the Civil War, was preceded by years of talk, if not action. But in 2005 we barely have enough talk about what is happening to add up to a public conversation. We're too busy following Paris Hilton and Michael Jackson, or the NASCAR rankings, or the exploits of Donald Trump. We're immersed in a national personality freak show soap opera, with a side order of sports 24-7.

Our failure to pay attention to what is important is unprecedented, even supernatural.

This is true even at the supposedly highest level. The news section of last Sunday's New York Times did not contain one story about oil or gas - a week after Hurricane Rita destroyed or damaged hundreds of drilling rigs and production platforms in the Gulf of Mexico - which any thought person can see leading directly to a winter of hardship for many Americans who can barely afford to heat their homes - and the information about the damage around the Gulf was still just then coming in.

What is important?

We've entered a permanent world-wide energy crisis. The implications are enormous. It could put us out-of-business as a cohesive society.

We face a crisis in finance, which will be a consequence of the energy predicament as well as a broad and deep lapse in our standards, values, and behavior in financial affairs.

We face a crisis in practical living arrangements as the infrastructure of suburbia becomes hopelessly unaffordable to run. How will fill our gas tanks to make those long commutes? How will we heat the 3500 square foot homes that people are already in? How will we run the yellow school bus fleets? How will we heat the schools?

What will happen to the economy connected with the easy motoring utopia - the building of ever more McHouses, WalMarts, office parks, and Pizza Huts? Over the past thirty days, with gasoline prices ratcheting above $3 a gallon, individuals all over America are deciding not to buy that new house in Partridge Acres, 34 miles from Dallas (or Minneapolis, or Denver, or Boston). Those individual choices will soon add up, and an economy addicted to that activity will be in trouble.

The housing bubble has virtually become our economy. Subtract it from everything else and there's not much left besides haircutting, fried chicken, and open heart surgery.

And, of course, as the housing bubble deflates, the magical mortgage machinery spinning off a fabulous stream of hallucinated credit, to be re-packaged as tradable debt, will also stop flowing into the finance sector.

We face a series of ramifying, self-reinforcing, terrifying breaks from business-as-usual, and we are not prepared. We are not talking about it in the traditional forums - only in the wilderness of the internet.

Mostly we face a crisis of clear thinking which will lead to further crises of authority and legitimacy - of who can be trusted to hold this project of civilization together.

Americans were once a brave and forward-looking people, willing to face the facts, willing to work hard, to acknowledge the common good and contribute to it, willing to make difficult choices. We've become a nation of overfed clowns and crybabies, afraid of the truth, indifferent to the common good, hardly even a common culture, selfish, belligerent, narcissistic whiners seeking every means possible to live outside a reality-based community.

These are the consequences of a value system that puts comfort, convenience, and leisure above all other considerations. These are not enough to hold a civilization together. We've signed off on all other values since the end of World War Two. Our great victory over manifest evil half a century ago was such a triumph that we have effectively - and incrementally - excused ourselves from all other duties, obligations and responsibilities.Which is exactly why we have come to refer to ourselves as consumers. That's what we call ourselves on TV, in the newspapers, in the legislatures. Consumers. What a degrading label for people who used to be citizens.

Consumers have no duties, obligations, or responsibilities to anything besides their own desire to eat more Cheez Doodles and drink more beer. Think about yourself that way for twenty or thirty years and it will affect the collective spirit very negatively. And our behavior. The biggest losers, of course, end up being the generations of human beings who will follow us, because in the course of mutating into consumers, preoccupied with our Cheez Doodle consumption, we gave up on the common good, which means that we gave up on the future, and the people who will dwell in it.

There are a few other impediments to our collective thinking which obstruct a coherent public discussion of the events facing us which I call the Long Emergency. They can be described with precision.

Because the creation of suburbia was the greatest misallocation of resources in the history of the world, it has entailed a powerful psychology of previous investment - meaning, that we have put so much of our collective wealth into a particular infrastructure for daily life, that we can't imagine changing it, or reforming it, or letting go of it. The psychology of previous investment is exactly what makes this way of life non-negotiable.

Another obstacle to clear thinking I refer to as the Las Vegas-i-zation of the American mind. The ethos of gambling is based on a particular idea: the belief that it is possible to get something for nothing. The psychology of unearned riches. This idea has now insidiously crept out of the casinos and spread far-and-wide and lodged itself in every corner of our lives. It's there in the interest-only, no down payment, quarter million-dollar mortgages given to people with no record of ever paying back a loan. It's there in the grade inflation of the ivy league colleges where everybody gets As and Bs regardless of performance. It's in the rap videos of young men flashing 10,000-dollar watches acquired by making up nursery rhymes about gangster life - and in the taboos that prevent us from even talking about that. It's in the suburbanite's sense of entitlement to a supposedly non-negotiable easy motoring existence.

The idea that it's possible to get something for nothing is alive and rampant among those who think we can run the interstate highway system and Walt Disney World on bio-diesel or solar power.

People who believe that it is possible to get something for nothing have trouble living in a reality-based community.

This is even true of the well-intentioned lady in my neighborhood who drives a Ford Expedition with the War Is Not the Answer bumper sticker on it. The truth, for her, is that War IS the Answer. She needs to get down with that. She needs to prepare to send her children to be blown up in Asia.

The Las Vegas-i-zation of the American mind is a pernicious idea in itself, but it is compounded by another mental problem, which I call the Jiminy Cricket syndrome. Jiminy Cricket was Pinocchio's little sidekick in the Walt Disney Cartoon feature. The idea is that when you wish upon a star, your dreams come true. It's a nice sentiment for children, perhaps, but not really suited to adults who have to live in a reality-based community, especially in difficult times.

The idea - that when you wish upon a star, your dreams come true - obviously comes from the immersive environment of advertising and the movies, which is to say, an immersive environment of make-believe, of pretend. Trouble is, the world-wide energy crisis is not make-believe, and we can't pretend our way through it, and those of us who are adults cannot afford to think like children, no matter how comforting it is.

Combine when you wish upon a star, your dreams come true with the belief that it is possible to get something for nothing, and the psychology of previous investment and you get a powerful recipe for mass delusional thinking.As our society comes under increasing stress, we're liable to see increased delusional thinking, as worried people retreat further into make-believe and pretend.

The desperate defense of our supposedly non-negotiable way of life may lead to delusional politics that we have never seen before in this land. An angry and grievance-filled public may turn to political maniacs to preserve their entitlements to the easy motoring utopia - even while reality negotiates things for us.

I maintain that we may see leaders far more dangerous in our future than George W. Bush.The last thing that this group needs is to get sidetracked in paranoid conspiracy politics, such as the idea that Dick Cheney orchestrated the World Trade Center attacks, which I regard as just another form of make-believe.This is what we have to overcome to face the reality-based challenges of our time.

At the bottom of the Peak Oil issue is the fear that we're not going to make it.

The Long Emergency looming before us is going to produce a lot of losers. Economic losers. People who will lose jobs, vocations, incomes, possessions, assets - and never get them back. Social losers. People who will lose position, power, advantage. And just plain losers, people who will lose their health and their lives.

There are no magic remedies for what we face, but there are intelligent responses that we can marshal individually and collectively. We will have to do what circumstances require of us.

We are faced with the necessity to downscale, re-scale, right-size, and reorganize all the fundamental activities of daily life: the way we grow food; the way we conduct everyday commerce and the manufacture of things that we need; the way we school our children; the size, shape, and scale of our towns and cities.

These are huge tasks. How can we bring a reality-based spirit to them?

I have a suggestion. Let's start with one down-to-earth project that we can take on with confidence, something we have a reasonable shot at accomplishing, and fairly quickly, something that will address our energy problems directly and will make a difference for the better. Let's get started rebuilding the passenger railroad system in our country.Nothing else we might do would make such a substantial impact on our outlandish oil consumption.

We have a railroad system that the Bulgarians would be ashamed of.

The fact that we are not talking about this shows how deeply unserious we are - especially the Democratic party. I am a registered Democrat. Where is my party on this issue? Where was John Kerry? Where are Senators Hillary Clinton and Charles Schumer? We should demand that they get serious about rebuilding the public transit of America - not next month or next year but tomorrow, starting at the crack of dawn.

Any person or any group who finds themselves in trouble has to begin somewhere. They have to take a step that will prove to themselves that they are not helpless, that they are capable of accomplishing something, and accomplishing that first thing will build the confidence to move on to the next step.

That's how people save themselves, how they reconnect with reality-based virtue.

We were once such a people. We were brave, resourceful, generous, and earnest. The last thing we believed was the idea that it was possible to get something for nothing. That we were entitled to a particular outcome in life, apart from the choices we made and how we acted. We can recover those forsaken elements of our collective character. We can be guided, as Abraham Lincoln said, by the better angels of our nature.

We lived in a beautiful country with vibrant towns and cities, and a gorgeous, productive rural landscape, and we were sufficiently rewarded by them so we did feel driven to seek refuge in make-believe all the livelong day. When we wanted to accomplish something we set out to do it, to make it happen, not merely to wish for it. We knew the difference between wishing and doing - which is probably the most important thing that adult human beings can know.

I hope we can get back to being that kind of people. This effort here today is a good start.

END

Wednesday, October 05, 2005

gas is going up(side down)

There will also be a lot of talk about how this problem is short-term. I liken the situation to driving around on bald tires. We just had a blow out. Will we buy a new set or just patch up the hole and get back on the road? Tires, by the way, are made of oil.

Lately people have also been asking me about price gouging by oil and gas producers and distributors. Insert interesting argument about the revered law of supply and demand here. Greedy convenience store owners aside, I don't think the bigger boys are interested in taking short term profits above normal margins. In fact I think oil and gas companies will be willing to take it on the chin to a certain extent in order to stave off that sort of criticism. I think though that they do see hurricane-related shortages as a way to raise the public's threshold for higher gas prices. In the past if Exxon or Shell or any of the other oil companies increased prices they would have taken quite a bit of heat. Just look at the protests going on in Indonesia. Now they can point the finger at natural disasters. They understand that the adult American pubic currently has the attention span of a 4 year old and will get used to higher gas prices fairly quickly as long as news of Demi Moore’s latest wedding keeps pouring in. Think, we are no longer talking about when gas will drop back below $2/gallon. We’re checking websites to see who has it for less than $3.

But let’s stop for a moment and examine the effect of a price hike of $1 a gallon for gasoline on someone like me. I drive approximately 350 miles per week. My 1993 Nissan Sentra gets approximately 35 miles/gallon (wanna trade Excursion boy?). That means I use approximately 10 gallons of gas per week. At $2/gallon I spend $20 per week on fuel. Increase the price by $1 a gallon and I’m spending $30 per week. That’s an increase of only $10 per week. That just means I can’t go to Starbucks every morning. It doesn’t mean I’m canceling Christmas. Even if you look at those people who drive cars 1/3 as efficient as mine, say 12 miles per gallon. They would still only be paying $30 additional dollars per week to drive. That ain’t the end off the world either. It’s just sticker shock. But back to Christmas…

More important than the price of gasoline during the last week of september 2005, I would tell you to keep an eye on 2 coming events: the natural gas shortage (and subsequent price increases as we head into winter) AND the holiday spending numbers. Natural gas shortages (the Unites States’ recovery of the stuff was in decline before the storm by the way) will cost people either alot of money or their lives this winter. This will curb spending which will sucker punch the economy as well as scare the poo out of everyone. It’s one thing to cancel your Christmas shopping plans because of sticker shock, it's quite another not to be able to keep your children from freezing to death. Also a drop in consumer confidence (already happening) coupled with a rise in the price of everything made of oil or transported by oil (in other words everything) will cause people to be able to afford considerably less than this time last year. I’m not hoping for it but I think a recession beginning this winter is a pretty safe bet. I’ll go out on a limb- the Dow closes under 8,000 by New Year’s Day 2006.

With that happy prediction out of the way my advice: Do some serious thinking about where your heat comes from. Do the same concerning your local electrical service. Ask family and friends to do some similar thinking. Walk through your safety preparedness- food, water, solar-powered battery chargers, etc. Consider taking some cash out of the market or even out of the bank for emergencies sake. Perhaps purchase some gold or other precious metals as investments during down times. It’s important not to have to think about these things in the dark. Planning for them won't make them happen but it will mean you're better prepared if they do.